[T]he development of capitalist production makes it constantly necessary to keep increasing the amount of capital laid out in a given industrial undertaking, and competition makes the… laws of capitalist production to be felt by each individual capitalist as external coercive laws. It compels him to keep constantly extending his capital, in order to preserve it, but extend it he cannot, except by means of progressive accumulation.

-Karl Marx, Capital, Volume 1, Chapter 24, Section 3

Which Marx was the funniest? Most people say Groucho or Chico, but, for my money, it has to be Karl. 1)Although the normally dour Schumpeter gets an honourable mention for his memorable quote: ‘I wanted to be the world’s greatest economist, the world’s greatest horseman, and the world’s greatest lover. Two out of three isn’t bad’. I never knew Meatloaf read economics. He was by far the best writer for an economist – admittedly not a very high bar 2) John Kenneth Galbraith – a fellow Canadian – is a shining light of insight and incisiveness in his writings. He was Professor Emeritus when I arrived at Harvard and it is one my greatest regrets that I fell in with the graduate student crowd that saw him as yesterday’s economist and never had contact. The reality is he was an intellectual giant trying to fight an unstoppable tide of academic poppycock that has been the economic orthodoxy for the past 30 years. – with wonderfully crafted prose and that cutting wit demanded of Europe’s educated class that is still an essential requirement of English public 3)Where, in that peculiar fashion of the English, public means private here: Eton, Winchester, Dulwich College, etcetera. school boys today.

And while we can have a spirited debate about the merits of his economic theories and observations, there is one point on which there can be no dispute: the logic of the capitalist system requires growth. Capital begets capital and, like water rushing downhill, capital will always search for the opportunities at hand, and search further afield when those are not readily available.

I see this everyday in Nigeria. As developed economies are saturated and growth slows, people now realize that Nigeria – despite its awesomely (and deservedly) poor reputation, its completely inadequate infrastructure, and its depressingly high levels of waste and corruption – is the next big thing. With 170 million people, a young and rapidly growing population, and huge purchasing power, it is in the top 3 list of more and more global companies, and is already the largest market for two iconic brands – Guinness and Blackberry. Well, one formerly iconic brand, still revered by Canadians.

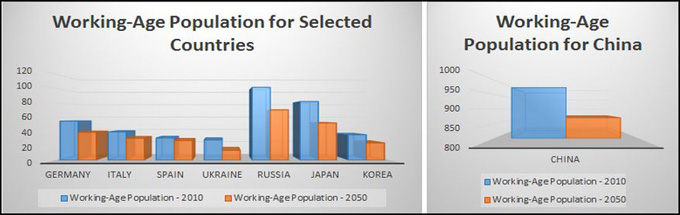

But this article is not about growth. It is about decline, because the reality is that a key driver of economic growth – demographics – cannot go on forever and we are now at the point where we need to figure out how to manage an economy when populations are stagnant or declining. Figure 1 shows the total population, the total working age population (15-64, according to The World Bank), and median age for 8 key countries.

Figure 1 – Population 4)“Total Population by Country, 1950, 2000, 2015, 2025, 2050,” United Nations Population Division, 2001., Working Age Population 5)Hayutin, Adele, “Population Age Shifts Will Reshape Global Work Force,” Stanford Center on Longevity, 2010., CAGR of Working Age PopulationOf course, this is not the entire world, but collectively these countries are about a quarter of the world’s population and 34% of GDP in 2012.6)“World Development Indicators,” The World Bank, 2013.curs that just takes a bit of finessing… will keep my eye on all these as we build as some difficulties will surely arise upon upload. And all of them have falling populations and an even faster decline in working age populations as their societies age.

In the case of Japan, for example, the country is committing demographic suicide. The TFR (total fertility rate – reflecting the average number of children per woman) is currently 1.39. Working age population reached its peak in 1994. The working population is declining at a rate of 0.61% per annum.7)“World Development Indicators,” The World Bank, 2013.

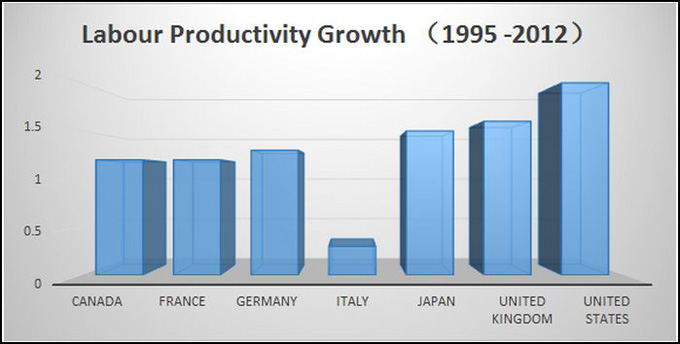

Figure 2: Average Increase in Labour Productivity Growth for the G-7 countries, Ranging from 0.3 to 2. 8)“Labour Productivity Growth in the Total Economy,” OECD, StatExtracts, 2013.Of course a decline in the number of people working can be compensated by increases in productivity. As the reader can see, the range of productivity growths is from -0.3% for Italy to 2.0% for the US. In the case of Japan, the productivity growth is 1.5%, which is excellent performance, despite the histrionics in the financial press. Nonetheless, if the working age population is shrinking by 0.6% per annum, and productivity is increasing 1.5% per annum, then mathematics will tell you your economy is going to grow pretty slowly – less than 1% per annum in Japan’s case.

And – as mentioned – while these 8 countries cited with declining working age populations (in the first set of charts) are not the whole world, the rest of the world is looking more and more like these countries. Fertility rates have fallen much faster than would have been expected 30 years ago, with a pretty clear pattern of both education and urbanization of women and girls causing rapid declines in fertility. Women in Mumbai have no more babies than women in Chicago. 9)Ranade, Ajit, “An Unsung Success in Fertility,” Mumbai Mirror, Success in Fertility.10)Bocskay KA, Harper-Jemison DM, Clark J, Paik E and Jones RC, “Births in Chicago, 1999-2009.” City of Chicago, 2012.

So, while at a global level population and working age population are projected to increase at least until 2050 (with Africa and Asia leading the way), in large parts of the developed world, productivity gains (even very good productivity gains) will be offset partially or fully by declines in working age population. This means that total GDP will decline in an increasing number of countries and can grow only slowly in even more.

What happens in an economy when it reaches this point? All of our economic and business orthodoxy is built around growth.11)Here is a thought experiment. A listed company CEO stands up as says his company will no longer grow, but will be stable and profitable at the existing revenue level. What will happen to the share price? I am pretty sure it will not rise. What is the new orthodoxy when growth stops? Of course, innovation may – and should – continue, and GDP per capita can continue to rise. But if economic collapse is to be avoided, we better figure this out.

Nevinomics thinks so – but there has not been any real thought to what are the economics of decline. So here are a few obvious points:

- Productivity has to increase a lot faster. The only way we can become wealthier is by becoming more productive. We need to make more of the goods and services we want and need with less input. It is to no one’s long-term benefit to use more resources to do things than we can continue to use. This means, then, that we must apply technology and be willing constantly to change, government services being an obvious area where change could be bolder.

-

Future commitments become a big problem – GDP is not going to grow much in absolute terms, so the state (or companies) are not in a position to make future promises (such as pensions) that require GDP growth to be achievable. The bankruptcy of Detroit is an obvious example, as the city’s population fell from 1,670,144 in 1960 12)Humbad, Shailesh N. “Detroit Population History 1900-2000.” Detroit Population History. to 701,475 in 2012 13)Census, U.S. “Detroit’s Population.” 2012..

-

Real estate prices fall – Real estate is very approximately 50% of the world’s assets. We have an orthodoxy that real estate prices go up – the British, for example, are peculiarly wedded to the notion that rapid (higher than the growth of nominal GDP) real estate price growth is a sign of a healthy economy (which it is not). 14)If real estate prices go up that is not in any way an increase in well-being, as it is the same stock of housing deliver housing services. Of course, if it showed high demand for housing and could elicit a supply response, it would be a useful signal. Unfortunately in the UK housing prices rise, but there is little ability to increase desperately needed supply given local zoning laws, despite the central government’s attempt. Similarly, allowing foreigners to buy large amount of residential real estate – and then leave it empty – is not good economic or Flourishing policy for a variety of reasons, though the UK seems to think it is a national economic strategy. Switzerland – intelligently – had addressed this issue with a focus on lits froids – foreigners buying condos then not occupying them has literally sucked the life out of resort towns. In a flat or declining GDP world, real estate prices decline, as has been shown by the experience of Germany and Japan. And because current real estate prices depend on future real estate prices, once the market knows there will be decline, it is immediately priced in.

-

Dependency Ratio increases – Without changes in the structure of the labour force, the dependency ratio (the ratio of workers to non-workers in the economy) increases, putting more tax pressure on those working.

-

Density declines – As density declines, Flourishing is put under pressure as Flourishing-enhancing activities – public transport, the arts, education, sports – are all easier to achieve in higher-density locations, in much the same way that the ecosystems of Brazil or Congo’s rain forests have a higher metabolism than those of the Arctic.

And, of course, for those countries to whom it matters, global (or regional) power and influence declines.

In the case of Russia, which, judging by its actions, values its geopolitical position more than the Flourishing of its people, demographic decline started in 1991 (just before the dissolution of the USSR), with a peak population of almost 149m. This has been declining continuously since then, reaching 143.5 million in 2012. 15)“Population, total.” The World Bank, 2013. Without action, projections were that the Russian population would fall to less than 100 million by 2050; with barely more than 1% of the world’s population, its global influence would inevitably decline. Given this, it has been an urgent part of President Putin’s policies to reverse this and, in 2010, Russia managed to have a modest 0.5% increase in population.

Putting aside geopolitical issues, the obvious conclusion Nevinomics has reached is that the potential for an individual to Flourish needs to be decoupled from absolute GDP growth when the population is declining.

To put this another way, it is undoubtedly easier to Flourish in a high GDP growth world because a lot more is going on (or it is easier to deflect attention from the lack of Flourishing in a high growth GDP world).

However, this is not the situation, and we need to find ways for people in developed, population-declining societies to Flourish – even though GDP growth is low – and to do so in a way that is sustainable. Artificial props to GDP growth – like the housing-induced boom (and bust) in the US – are not a substitute for intelligent policies that create Flourishing even though GDP growth is low.

So to Flourish in the low GDP growth world, good policy needs to be made around all these issues: future commitments, falling real estate prices, increasing dependency ratio, and decreased density.

Here are a few ideas (in increasing degrees of radical thinking):

-

Do not allow future unfunded commitments by any level of government below the national level, as these are not credible and can lead to undue hardship and suffering – as we have seen in Detroit. If it cannot be funded now, it cannot be funded in the future. This requires changes to public sector accounting standards that are too loose.

-

Lead by example with state workers, creating flexible career paths where employees in their 60s and 70s have redesigned job responsibilities and time commitments (with reduced compensation) to help keep them in the workforce (voluntarily) 16)Nevinomics does not believe raising the mandatory retirement age is good policy for Flourishing for reasons discussed in article 4-1: Who Can Manage Their Own Lifetime Risk to increase the dependency ratio.

-

Work with – and pressure – the largest corporations to make the same structural adjustments to their labour forces, essentially showing the entire economy that it can be done.

-

Commit to zoning regulations that will prevent housing price bubbles 17)This also requires sensible regulation of banks and other lenders to prevent housing bubbles through the type of lending practices we saw in the UK and US in 2002-2007. – specifically, if there is upward pricing pressure, policies will allow more housing to be built. Publicly announce that people should not view their homes as an investment (because in a flat or declining population scenario it is not, as many people with 5 bedroom houses on the outskirts of Toronto will find out when they want to cash out).

-

Gradually reorient the tax system to have a higher percentage of taxes collected from property – this needs to be done slowly as it will cause real estate prices to fall, so not fair to existing homeowners if done too quickly.

-

Be much bolder in large-scale infrastructure interventions that are required to modernize and adapt to changing demographics. Be prepared to zone entire areas as residential or business free, returning to park space for public use, while concentrating business and residential activity in certain zones. In addition to creating fit-for-purpose urban environments, this will also create massive employment. 18)While most of us think of HK as densely populated, it actually has the highest percentage of green space of any large city (70%), as very restrictive zoning ensures high density in some areas and natural scenery – enjoyed by all – in others. This also has the advantage of creating the density required for high-metabolism Flourishing. See SkyScraperCity.com. And much of this employment will be high wage because of the skills required to build these types of projects from aesthetic, energy, material, and architectural perspectives.

These policies have a common thread: active interventions to maintain a high level of economic metabolism 19)Which, of course is no different than the active interventions to save the financial system after the GFC. It is always remarkable to me that orthodox economists claim they advocate ‘free markets’ (whatever that means) while simultaneously being among the biggest boosters of massive and continuous intervention in the biggest market of all – the market for money. Let us hope that QE does not lead to bigger problems. despite a flat or declining population. And it requires boldness to take actions that increase this metabolism (and increase productivity) given that many of these actions require breaking down entrenched interests (such as reclaiming land). So the path of least resistance is to do nothing, which more often than not is what we see from the public sector. After all, who is up for all the headaches of a conflict when you can ignore the issue and enjoy a slow decline?

To put all this another way, the economic miracle of post-WWII period in developed countries was a gift – demographics, pent-up demand, and the demolition of the prior infrastructure and economy created the white space for the economy to grow and change. Like the quip about George Bush and 3rd base, 20)George Bush (III) was born on 3rd base – with all his incredible privileges – but thought he hit a triple. You have to be American (or Canadian) to understand this. economists believed this tremendous success was due to a combination of their remarkable insight and the superiority of a certain way of organizing the economy.

Unfortunately, both of these beliefs are wrong; this era is over and the hard work begins continuously to construct a better and better economy. The economy has to move forward despite the shrinking economically active population and against the inertia of most of the white space filled in – think of growing grain in the empty fields 21)Well, empty after disease (mainly) and violence wiped out the previous inhabitants. of the American mid-west of the 1800s versus trying to change the dense ecosystem of the Amazon rainforest where the canopy takes all the light before it reaches the ground, retarding growth of other species. In these circumstances, Schumpeter’s creative destruction will require a helping hand.

Photo: El Neill

Footnotes

| 1. | ↑ | Although the normally dour Schumpeter gets an honourable mention for his memorable quote: ‘I wanted to be the world’s greatest economist, the world’s greatest horseman, and the world’s greatest lover. Two out of three isn’t bad’. I never knew Meatloaf read economics. |

| 2. | ↑ | John Kenneth Galbraith – a fellow Canadian – is a shining light of insight and incisiveness in his writings. He was Professor Emeritus when I arrived at Harvard and it is one my greatest regrets that I fell in with the graduate student crowd that saw him as yesterday’s economist and never had contact. The reality is he was an intellectual giant trying to fight an unstoppable tide of academic poppycock that has been the economic orthodoxy for the past 30 years. |

| 3. | ↑ | Where, in that peculiar fashion of the English, public means private here: Eton, Winchester, Dulwich College, etcetera. |

| 4. | ↑ | “Total Population by Country, 1950, 2000, 2015, 2025, 2050,” United Nations Population Division, 2001. |

| 5. | ↑ | Hayutin, Adele, “Population Age Shifts Will Reshape Global Work Force,” Stanford Center on Longevity, 2010. |

| 6. | ↑ | “World Development Indicators,” The World Bank, 2013.curs that just takes a bit of finessing… will keep my eye on all these as we build as some difficulties will surely arise upon upload. |

| 7. | ↑ | “World Development Indicators,” The World Bank, 2013. |

| 8. | ↑ | “Labour Productivity Growth in the Total Economy,” OECD, StatExtracts, 2013. |

| 9. | ↑ | Ranade, Ajit, “An Unsung Success in Fertility,” Mumbai Mirror, Success in Fertility. |

| 10. | ↑ | Bocskay KA, Harper-Jemison DM, Clark J, Paik E and Jones RC, “Births in Chicago, 1999-2009.” City of Chicago, 2012. |

| 11. | ↑ | Here is a thought experiment. A listed company CEO stands up as says his company will no longer grow, but will be stable and profitable at the existing revenue level. What will happen to the share price? I am pretty sure it will not rise. |

| 12. | ↑ | Humbad, Shailesh N. “Detroit Population History 1900-2000.” Detroit Population History. |

| 13. | ↑ | Census, U.S. “Detroit’s Population.” 2012. |

| 14. | ↑ | If real estate prices go up that is not in any way an increase in well-being, as it is the same stock of housing deliver housing services. Of course, if it showed high demand for housing and could elicit a supply response, it would be a useful signal. Unfortunately in the UK housing prices rise, but there is little ability to increase desperately needed supply given local zoning laws, despite the central government’s attempt. Similarly, allowing foreigners to buy large amount of residential real estate – and then leave it empty – is not good economic or Flourishing policy for a variety of reasons, though the UK seems to think it is a national economic strategy. Switzerland – intelligently – had addressed this issue with a focus on lits froids – foreigners buying condos then not occupying them has literally sucked the life out of resort towns. |

| 15. | ↑ | “Population, total.” The World Bank, 2013. |

| 16. | ↑ | Nevinomics does not believe raising the mandatory retirement age is good policy for Flourishing for reasons discussed in article 4-1: Who Can Manage Their Own Lifetime Risk |

| 17. | ↑ | This also requires sensible regulation of banks and other lenders to prevent housing bubbles through the type of lending practices we saw in the UK and US in 2002-2007. |

| 18. | ↑ | While most of us think of HK as densely populated, it actually has the highest percentage of green space of any large city (70%), as very restrictive zoning ensures high density in some areas and natural scenery – enjoyed by all – in others. This also has the advantage of creating the density required for high-metabolism Flourishing. See SkyScraperCity.com. |

| 19. | ↑ | Which, of course is no different than the active interventions to save the financial system after the GFC. It is always remarkable to me that orthodox economists claim they advocate ‘free markets’ (whatever that means) while simultaneously being among the biggest boosters of massive and continuous intervention in the biggest market of all – the market for money. Let us hope that QE does not lead to bigger problems. |

| 20. | ↑ | George Bush (III) was born on 3rd base – with all his incredible privileges – but thought he hit a triple. You have to be American (or Canadian) to understand this. |

| 21. | ↑ | Well, empty after disease (mainly) and violence wiped out the previous inhabitants. |